BUBS Naturals Sees More List Growth in 30 Days on Postscript Than 1.5 Years on Attentive

BUBS Naturals uses sustainably sourced ingredients to create collagen protein supplements and other nutritional products that are designed to help you feel and live a healthier, fuller life. Inspired by the heroic life of Glen “BUB” Doherty, the BUBS Naturals brand is defined by its commitment to quality, communal spirit, and charity. The company donates 10% of all to the Glen Doherty Memorial Foundation, which was established to help ease the transition to civilian life for the special ops community.

“We saw that open rate, clickthrough rate, and purchase rate on SMS was infinitely faster and better than it was on email.”

TJ Ferrara

Co-Founder

Jumpstarting a Real SMS Strategy

Once they realized how impactful SMS could be, Lake and Ferrara went in search of a true text marketing platform—something that went beyond simple reminders and transactional messages.

They ended up on Attentive, bringing around 21,000 subscribers with them. But without targeted messaging and a tailored strategy around subscriber acquisition, the results they got were lackluster, to say the least.

“It was about as ‘blanket strategy’ as it gets,” Ferrara recalled. “Like, ‘Here’s what’s working for all our other clients. You should do the same. See ya later!’”

By the time they switched to Postscript in August 2022, they had actually lost subscribers. But, their belief in SMS was still strong—especially after their initial conversations with the Postscript team. “It was like, oh,wait a minute—this is a real SMS company,” Ferrara said.

Making the Switch to Postscript

While leaving Attentive was, in Ferrara’s words, “a pain,” he said getting started with Postscript was the exact opposite. “Onboarding with Postscript was cake,” he said. “Again, your team—everyone that I’m working with—prime.”

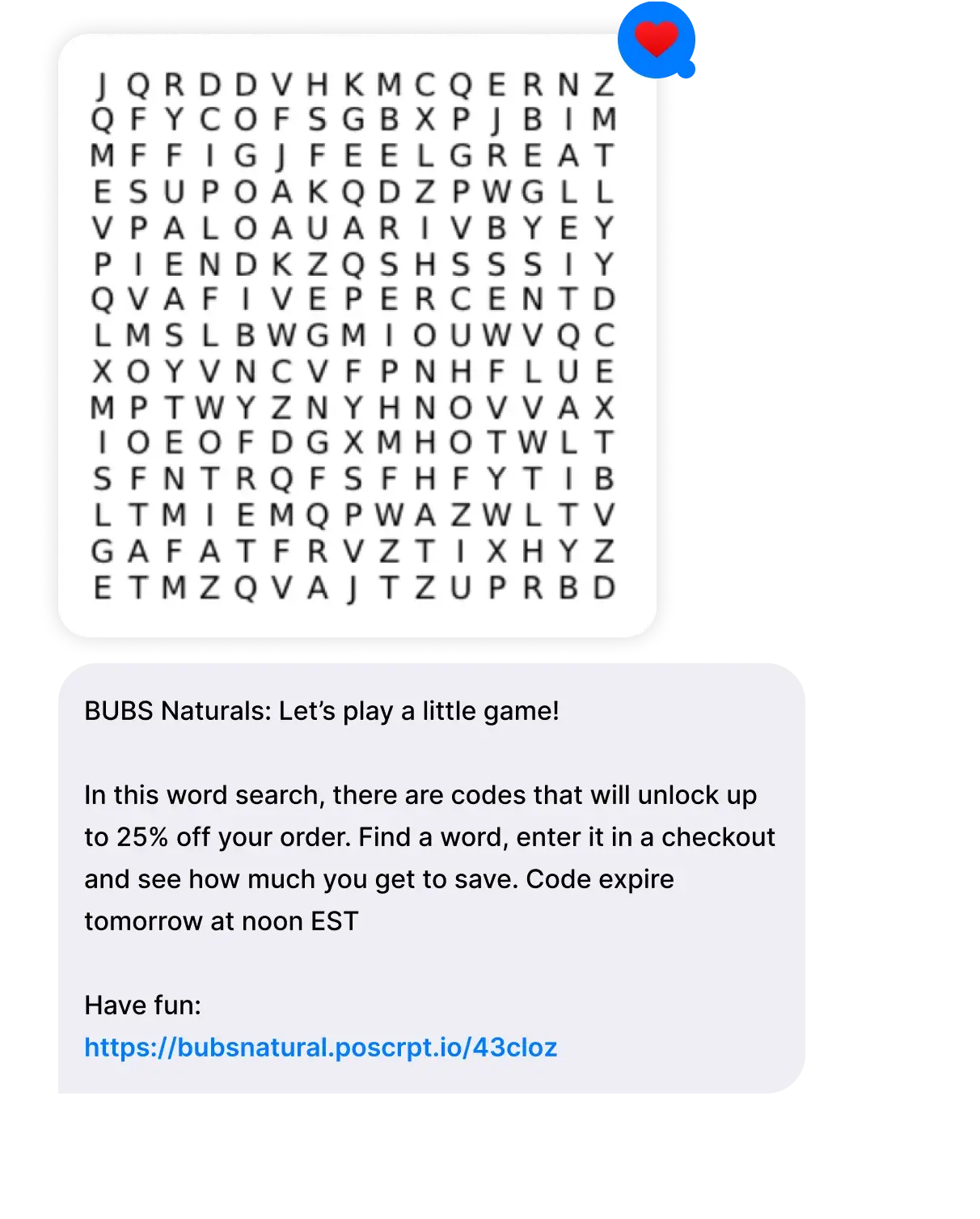

The Postscript team wasted no time getting BUBS Naturals set up with a revenue-driving SMS strategy. In addition to creating optimized SMS opt-in popups and turning on phone number collection at checkout, BUBS Naturals began leveraging Postscript’s simple keyword opt-in functionality to grow their list at in-person events and via promotional giveaways.

On the messaging side, Ferrara worked with the Postscript Success team to develop a more engagement-focused campaign strategy and establish a more consistent sending cadence.

Replacing Coupons with Conversations

“We were having very different strategy sessions with Postscript,” Ferrara said. “Your team went through our site and learned everything about our brand without me having to say anything.”

That led to more productive brainstorming and strategy planning. For example, Ferrara recalls their rep encouraging them to highlight their charity involvement in their SMS content.

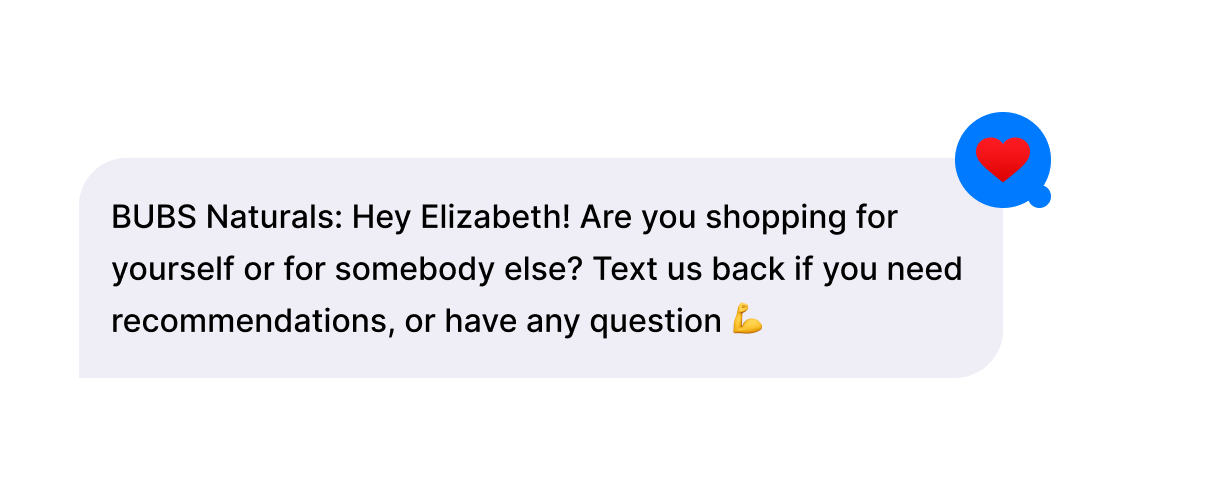

Whereas their strategy on Attentive was dependent on deep discounts, their strategy on Postscript is rooted in conversation and engagement. “I want to be on the conversation side,” Ferrara said. “I don’t want to be on the ‘push messaging’ side where it just shows up with a discount that says ‘buy our stuff’. That’s not fun for anybody and it doesn’t create retention.”

Since shifting away from a coupon-centric strategy, Ferrara says “the proof is in the pudding,” noting that they added more subscribers to their list in 30 days on Postscript than they did in 1.5 years on Attentive—all while increasing their monthly revenue and nurturing long-term relationships with their customers.

Segmenting Strategically

Ferrara especially loves how Postscript’s Campaign Flow Builder enables the team at BUBS Naturals to target subscribers based on their previous behavior or their engagement with the flow (e.g., clicked versus didn’t click or bought versus didn’t buy).

“Now we have segmentation—now we have those touchpoints so we can be more thoughtful about the who, what, when,” he said.

Supercharging their SMS Strategy with Postscript Plus

BUBS Naturals was so impressed with the knowledge and expertise of the Postscript team that when they had the opportunity to leverage Postscript Plus—Postscript’s in-house team of SMS strategists and content creators—it was “a no-brainer.” This allowed BUBS Naturals to offload a good portion of their SMS strategy and take their messaging to the next level.

Ferrara couldn’t be happier with the results, saying the team is incredibly proactive and always coming to him with “a number of fantastic ideas.”

“Everything Postscript Plus is doing on the strategy side, content creation side, and the engagement side—it’s awesome and I am so happy that I turned that over,” he said, adding that doing so has further fueled the conversational messaging fire.

“For the folks that are just generally operating on the reactive side of SMS, don’t,” Ferrara said. “Just hire Postscript Plus…trust me, the revenue is gonna come in 10, 20, 30x that!”

Solution and results

By expanding their subscriber acquisition efforts to include checkout collection and in-person keyword opt-ins, BUBS Naturals was able to significantly grow their SMS list in just 90 days. They’ve also leveraged Postscript’s in-house strategy resources to develop an engagement-focused, content-heavy SMS marketing program designed to maximize the long-term value of each subscriber. (Note: All results are accurate as of December 1, 2022.)

“For the folks that are just generally operating on the reactive side of SMS, don’t. Just hire Postscript Plus…trust me, the revenue is gonna come in 10, 20, 30x that!”

TJ Ferrara

Co-Founder